29 Sep 2017 Pierre Puybasset, Spokesman of the Fund Management team, La Financière de l’Echiquier

LH: Can you briefly introduce La Financière de l’Echiquier to us?

Pierre Puybasset: La Financière de l’Echiquier is an independent investment management specialist, founded in 1991 by Didier Le Menestrel, owned by its managers and employees. We employ approximately 100 people in 9 countries and our business has grown to €8.5bn of assets under management. The philosophy of our firm is very simply to be the best solutions provider for our clients.

Historically a stock-picking expert, we have evolved 10 years ago into a diversified player who brings diversified fund solutions. More recently, we invaded the alternative management space with a CTA Managed Futures fund, Echiquier QME, a solution dedicated to specialized investors who want to further diversify their portfolios by decorrelating their investments from traditional asset classes.

LH: How big is your investment team?

Pierre Puybasset: The fund management team is made up of 30 fund managers and analysts. Two strong characteristics differentiate us in my view: we don’t depend on external research – all our financial analysis is performed in-house – and our mindset is really collegial: our investment teams share constantly their investment research. This makes our database on companies quite unique, both on quantitative and qualitative aspects.

LH: How does your client base look like? Who is investing in the solutions provided by La Financière de l’Echiquier?

Pierre Puybasset: 65% of our AUM is coming from private individuals, either direct or through IFAs. The other 35% is coming from institutional clients who invest either directly in our open-ended funds our through mandates and dedicated funds.

Roughly 75% of our client base is in France, our home country. Outside France, we are serving clients in BeNeLux, Switzerland, Italy, Spain, Austria and Germany. On top of that, we also manage some mandates coming from Canada and Norway-based investors.

LH: Do you see more investment appetite form certain type of investors for an alternative CTA fund like Echiquier QME?

Pierre Puybasset: Only 12% of alternative funds are CTAs, which says it all: these strategies are not broadly known. Their complexity and technicality, associated with their diversity, make them easier to understand and adopt by the institutional side. As a private individual, the opportunity to invest in CTA strategies does not come up every day. This is where Echiquier QME wants to make a difference by offering a CTA fund in an accessible UCITS format. This is an interesting solution for people who often have their savings invested via a life insurance scheme that can only invest in UCITS compliant funds, as is often the case in France and Belgium for example.

LH: Can you provide us with some background on the fund Echiquier QME? How and when did you start trading the strategy?

Pierre Puybasset: We felt that our clients would benefit further if we enlarged our equity and diversified fund offer with alternatives. As a strategy, we were convinced that CTA & Managed Futures could have a lot of potential because it clearly decorrelates from equity and fixed income. As always, the first step in realizing this project was to find the right team.

Back then, Ludovic Berthe and Alexis Grutter were fund managers at HDF Finance which was a very well-known FoHF manager and a real specialist in quantitative and systematic strategies. They had developed a CTA strategy that they were trading with their own money, but it was not launched as a product at the time. When HDF was bought by a competitor, La Financière de l’Echiquier decided to take in the strategy, we seeded it with our own equity and launched it as an AIF fund in 2013.

LH: And how did the UCITS version of the strategy start?

Pierre Puybasset: The fund proved to be a very good diversifier, exactly as expected. After 2 years we decided that it would make a lot of sense to also offer the strategy to our clients on the retail side. Echiquier QME was launched as a UCITS fund in November 2015.

LH: According to your views, which role should CTA & Managed Futures strategies play in a broader portfolio of stocks and bonds?

Pierre Puybasset: With alternative strategies, providing true diversification is key. If, as an investor, you are looking for a strategy which moves independently from the main market indices, CTAs will offer you the best decorrelation you can get.

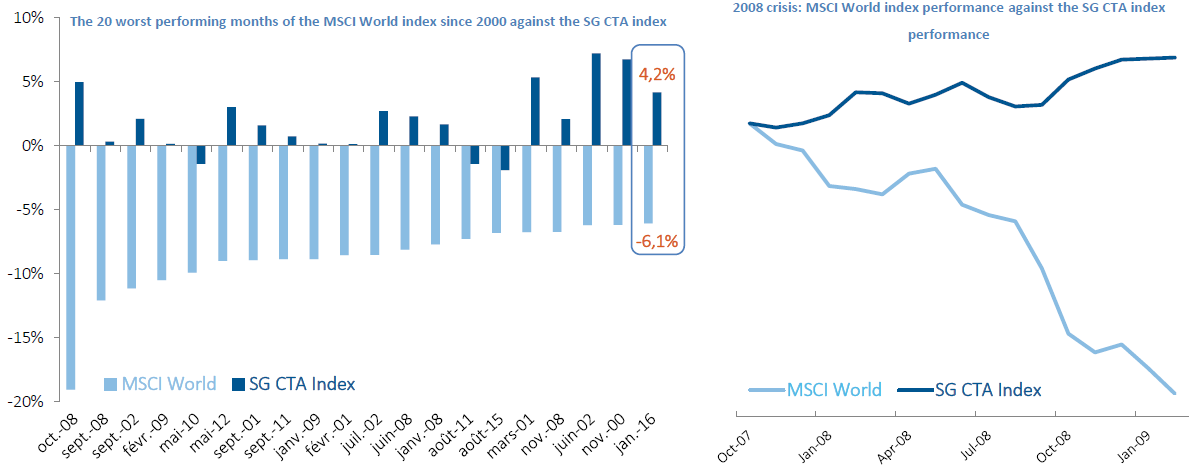

The correlation of the SG CTA index with the MSCI world index is even slightly negative (-0.11, between 1997 and 2016). This is the best example of a true alternative strategy; other alternative strategies like equity long/short, event driven or global macro keep a long equity bias and will thus offer less diversification in a portfolio.

Because of the way CTA strategies work and capture trends, they are uniquely positioned to benefit from downside momentum when markets are heavily down. When we look at the 20 worst performing months of the MSCI world since 2000, it is clear that CTAs often manage to generate positive performance in times of market stress and will work as portfolio shock absorbers.

LH: How exactly do your clients use Echiquier QME as a diversifier in their portfolios?

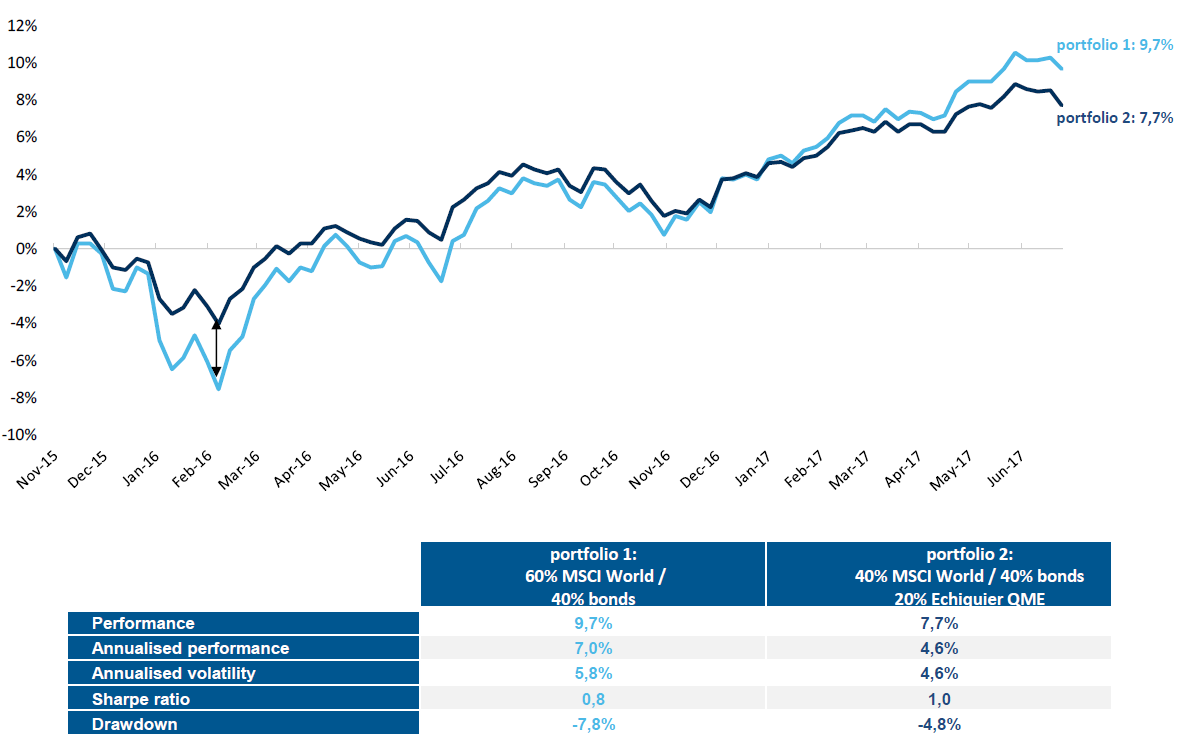

Pierre Puybasset: This differs a lot and depends of course on their own time horizon and risk/return expectations. To illustrate what Echiquier QME brings in a portfolio context, a historical simulation shows that the risk/return trade-off is improved and drawdowns are limited when the fund is added to a classic 60/40 stock/bond portfolio (see table below, data since fund launch in Nov. 2015). Even if this period has not been the most favourable for CTAs in general, it is clearly showing the benefits in terms of diversification and drawdown.

Portfolio comparison with and without Echiquier QME (*)

Source: La Financière de l’Echiquier. Past performance is not a guide to future performance and is not constant over time.

LH: Can you guide us through the investment strategy? How exactly is Echiquier QME generating its returns?

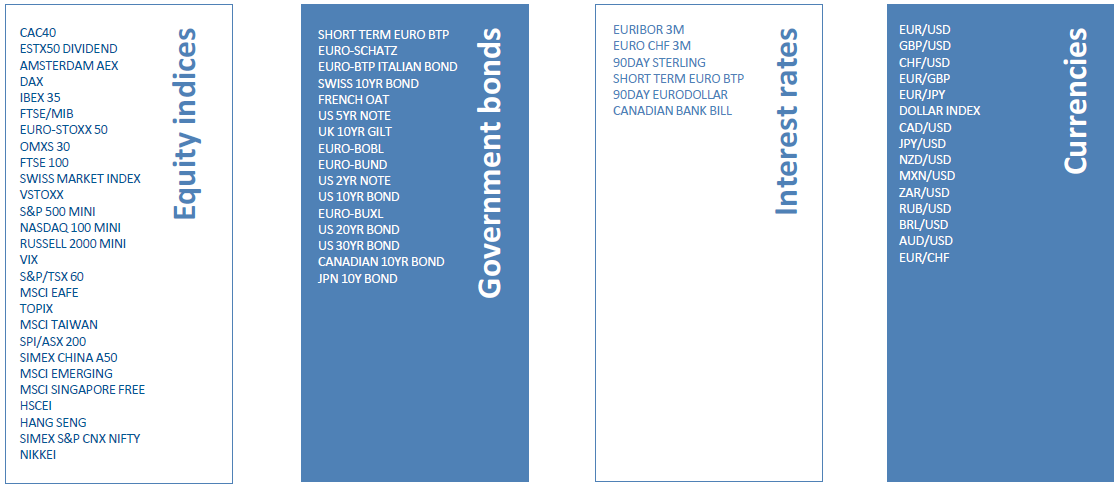

Pierre Puybasset: The core is a trend following strategy on different liquid futures markets: equity indices, government bonds, interest rates and forex. The AIF version of the fund also trades commodity futures, which are left out in the UCITS. While quite some CTAs are secretive about which markets they trade, we are always open on this topic and share a complete list of the 64 futures markets that are allocated into Echiquier QME’s strategy.

Among other things, trading liquid markets also keeps valuation of the fund pretty simple: the value we deliver every day is a pure reflection of the prices shown in the underlying futures markets.

The trading strategy is purely systematic and every CTA team has its own formula to generate long/neutral/short trading signals that dictate which positions to take. In terms of philosophy, we keep our formulas relatively simple because we don’t want to be overfitting the data. The more parameters you put into a formula, the less solid and robust it becomes when you trade the strategy live. Any serious professional, developing systematic quantitative strategies, knows that you can create a complex model with many parameters that shows stellar performance in a back test. These always fail when the strategy is live because the model is too complex and too much fitted to the historical data.

But the real difference of Echiquier QME with the competition lies in its “satellite strategies”, which were developed to support momentum strategies in specific market configurations and represent 30% of capital.

LH: Why do you mix in these satellite strategies?

Pierre Puybasset: We think that momentum is a true diversifier most of the time, but there are also some periods when it just does not work. 2017 has exactly been that type of year so far: low volatility without clear trends, or trends that did not last long enough for momentum strategies to profit from them. It is precisely in anticipation of such market conditions that we decided to create a pocket of satellite strategies. 2017 YTD results are a good illustration that it works: where most CTAs have struggled a lot (21/09/17: LuxHedge CTA UCITS index -2.19% YTD, SG CTA index -1.83% YTD), QME was able to avoid a loss and is currently at +1.58% YTD.

LH: What exactly are the satellite strategies?

Pierre Puybasset: The satellite part consists mostly of mean reversion and carry strategies, traded on the same markets as the momentum strategy. Again the signals are purely quantitative, programmed based on mean reversion laws for the different underlying assets.

LH: How do you combine or mix the trend following and satellite part?

Pierre Puybasset: Both are always active at all times with on average a 70/30 split that depends on the different signals that are generated. There is no human decision to allocate weights between the two parts. The momentum strategies focus on medium to long term market trending behaviour where the mean reversion part tends to exploit more short term market characteristics. One and the same market can show trending and mean reverting behaviour at the same time, it all depends on the time scale that you are looking at.

LH: Which underlying market has given the best performance in 2017?

Pierre Puybasset: There is no single market that we can point to and this is also a very typical situation. It is only the combined effect of all markets together that gives satisfying results. There are a lot of markets in our universe which all have to work together to produce a well-diversified result. Though, for 2017, we can say that equity indices have well performed (+4.5% at 31.08.2017).

LH: How does the UCITS fund perform versus the AIF version? Does leaving out the commodity markets make a big impact?

Pierre Puybasset: This is a very valid question, and its proper answer is… that it depends. This year for example is one where trend following commodity strategies do not work well, so we see the UCITS fund actually outperforming the AIF. In another context this may be different.

LH: Can you give us a future outlook on La Financière de l’Echiquier? Any future plans to launch more alternative funds?

Pierre Puybasset: Innovation has always been a key driver for La Financière de l’Echiquier over the years, and will continue to be. Our duty is to offer clients solutions that make sense for them, either by generating higher returns or by protecting their money with diversification over the long term. We will continue to be opportunistic in the future.

LH: To conclude, what would you say is the most diversifying feature of the Echiquier QME fund? What makes it different from other CTA UCITS out there?

Pierre Puybasset: Firstly, we mix in the satellite strategies which help to overcome an inherent weakness of CTAs in periods when markets are not trending. 2017 has perfectly illustrated so far why this makes a lot of sense.

Next to that, we are a smaller fund compared to most of our competitors, which means that we can address more underlying markets. Larger CTAs tend to be biased towards only the broadest and most liquid futures markets. Echiquier QME definitely has a benefit in that respect, as it can allocate more broadly, bringing more diversification and stability.

Many thanks Mr Puybasset for the interview!

Disclaimer

LuxHedge SA/NV is a limited liability company governed by the laws of the grand duchy of Luxembourg. This report is for Institutional Investors only and is not suitable for Retail Investors. The information herein is believed to be reliable and has been obtained from sources believed to be reliable, but we make no representation or warranty, express or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of such information. In addition we have no obligation to update, modify or amend this document or to otherwise notify a recipient in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate. Analyses and opinions contained herein may be based on assumptions that if altered can change the analyses or opinions expressed. Nothing contained herein shall constitute any representation or warranty as to future performance of any financial instrument, credit, currency rate or other market or economic measure. Furthermore, past performance is not necessarily indicative of future results. The recommendations mentioned herein involve numerous risks including, among others, market, counterparty default and illiquidity risk. An investor could lose its entire investment. This communication is provided for information purposes only. In addition, any subsequent offering will be at your request and will be subject to negotiation between us. It is not intended that any public offer will be made by us at any time, in respect of any potential transaction discussed herein. Any transaction that may be related to the subject matter of this communication will be made pursuant to separate and distinct documentation and in such case the information contained herein will be superseded in its entirety by such documentation in final form. By retaining this document, recipients acknowledge that they have read, understood and accepted the terms of this notice. Each recipient of this document agrees that all of the information contained herein is confidential, that the recipient will treat information confidentially, and that the recipient will not directly or indirectly duplicate or disclose this information without the prior written consent of LuxHedge. Recipients who do not wish to undertake a further investigation of the contents of this presentation agree to return this document promptly to the LuxHedge. This notice shall be governed by and construed in accordance with Luxembourg Law. This document and the information contained therein may only be distributed and published in jurisdictions in which such distribution and publication is permitted. Any direct or indirect distribution of this document into the United States, Canada or Japan, or to U.S. persons or U.S. residents, is prohibited.